Get a cost estimation

Get a cost estimation

Get a cost estimation

Get a cost estimation

As we all know, today's property market in Malaysia is not the easiest to navigate, particularly for new investors having to struggle with lower individual / household incomes to sustain the costs of down-payments and monthly mortgage payments. While you can offset your mortgage with income from tenants (using services such as ours ), the uncertainty and lack of resources has many people wondering - is property investment even worth it?

Here are a few reasons why we think indeed it is!

Being a young investor largely means being debt-free, which immediately gives you a credit-rating advantage. And because loans are only granted up to 70 years of age, it is way better to start paying off loans at an affordable (maximum loan tenure) rate now, rather than paying high premiums when you’re 40 or 50+. Your property may also benefit from good location, which means you earn higher rental rates (income) to offset monthly payments.

Your monthly payments may take away from daily luxuries such as the latest iPhone, fancy car, or expensive meals. But think 10 years down the line - it’ll pay off WAY more to have such an asset in your possession. Selling your property will earn you much more than you could have possibly saved in those 10 years. What’s more, you’d be earning current Ringgit values at that particular time, instead of accumulating savings that would still be subject to yearly inflation.

Without the burden of mortgage payments, most young professionals choose to spend their hard-earned money to take selfies in Chiang Rai and do one-legged standing yoga poses in Ubud. While these are all great experiences (show the sights a bit also laa ), is it really advisable to use the bulk of your paychecks to take bi-monthly or even quarterly holidays? It's much better to cut back on spending now because of an asset, rather than leisurely trips that you a) can do later and b) do not need so often. If Bali this year, then maybe kem-Bali only late next year.

As time goes by, real estate prices will steadily increase. Why? Think about it - available land is getting less and less in general. Building materials are becoming more and more expensive. Labour costs are increasing. These factors definitely point to an eventual rise in real estate prices, so it’s a great idea to secure your property while prices are (probably) as low as they’ll ever be.

Particularly for first-time buyers, the gov. has loads of incentives and schemes - just run a google search for Rumawip Kuala Lumpur or PR1MA Homes and you can apply for an affordable housing scheme. If you’re lucky enough to already have a family-owned property in Klang Valley, rent it out and earn some income!

In conclusion, picture yourself 10 years ahead of time; do you think you'd rather be happy with an asset that has appreciated in value over time? Or would it have been better to save money on the property and buy something else, a car for eg. (value steadily decreasing, probably a liability at this point)?

New to property investing?

The Makeover Guys helps property owners secure tenants and maximize their rental potential through tried & tested designs, cost-effective strategies, and useful market insights.

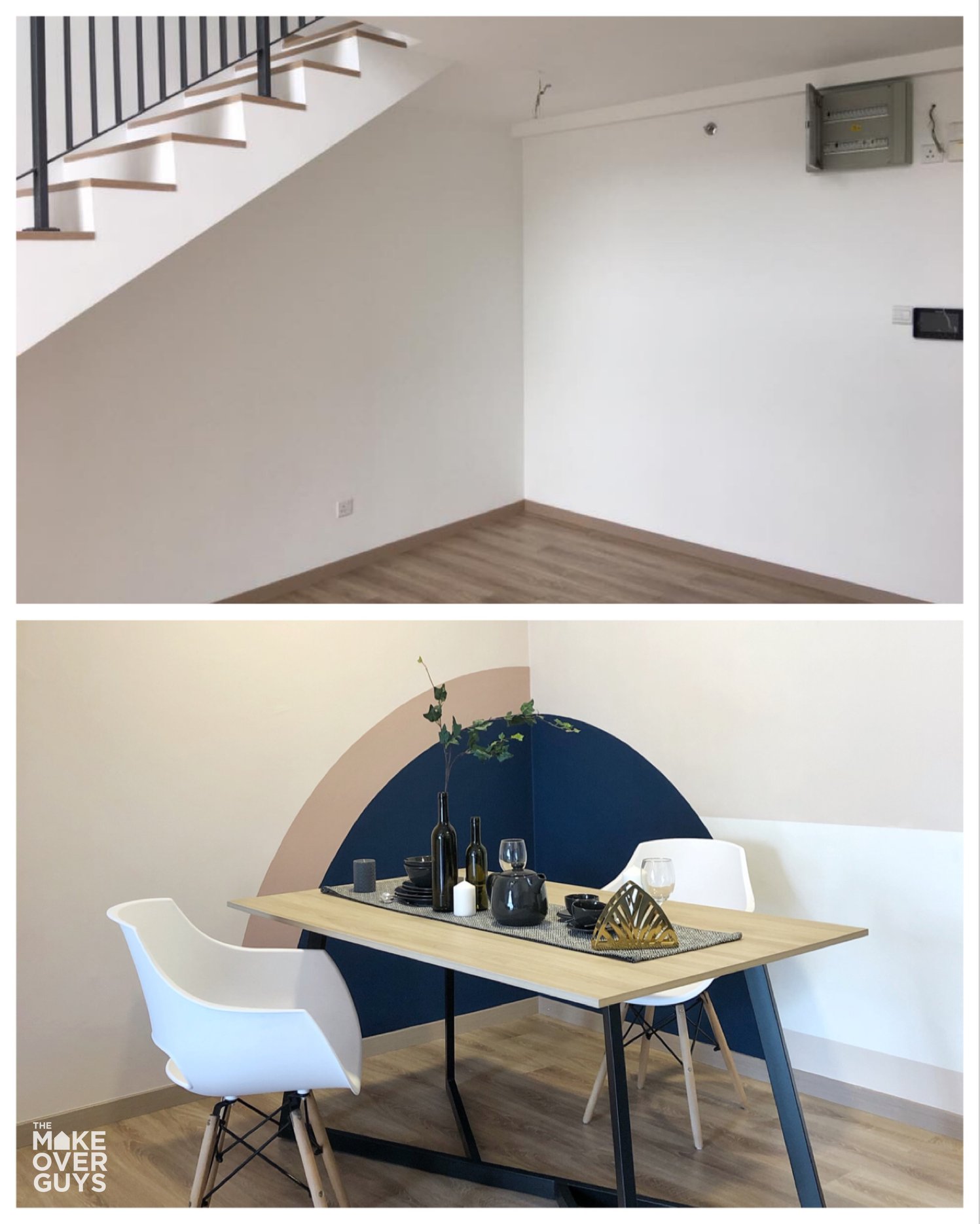

The pictures below are from our recently completed project at Emporis, Kota Damansara.

If you like what you see, send us a message today for a free property consultation!